…reconstructs Itori cement plant, to build the largest port at Olokola.

The President of the Dangote Group, Alhaji Aliko Dangote, has stated that his company decided to return and invest in Ogun State because of the Prince Dapo Abiodun administration’s vision and deliberate policies that focus on attracting investors, as well as the investor-friendly climate that exists in the state.

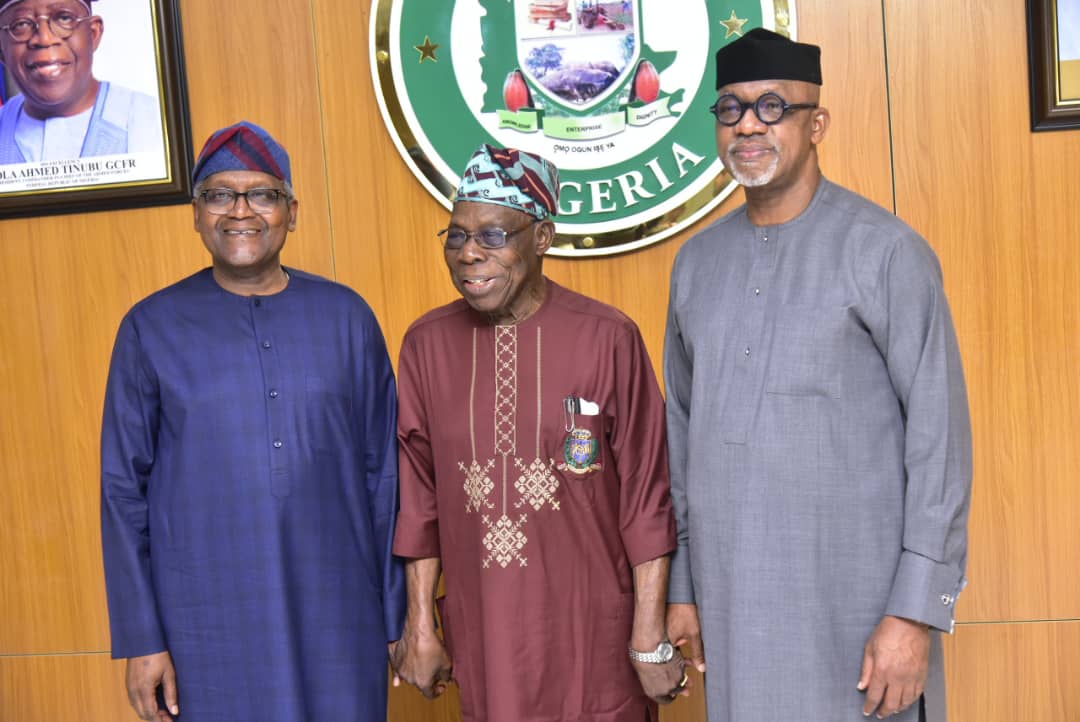

Dangote, who stated this on Monday during a courtesy visit to the governor in his office at Oke-Mosan, Abeokuta, said Ogun State is one of the most attractive investment destinations in Nigeria, positioning itself as the manufacturing ‘bedrock’ of Nigeria.

He said: “I would especially like to commend, in a special way, my good friend and brother, Your Excellency, the governor of Ogun State, for your vision and deliberate policies that focus on attracting enterprises through immense support for the private sector, which is now attracting investors.

“Our factory at Itori was pulled down twice. When we started the second time, they not only demolished the factory but also the fence, so we left. But right now, because of His Excellency, our governor, Prince Dapo Abiodun, we are back. When you visit the factory, you will be surprised at what we have done.

“We had earlier abandoned our vision of investing in the Olokola Free Trade Zone (OKFTZ), but because of your policies and investor-friendly environment, I want to say we are back and will work with the state government to return to Olokola, and plans are underway to construct the largest port in the country,” he pledged.

Giving an update on the company’s ongoing projects in the state, Alhaji Aliko Dangote said two new lines with a capacity of 6.0 million metric tons per annum for the cement plant have been constructed at Itori, while the 12 million metric tons per annum cement plant is also located at Ibeshe.

Upon completion, the Chief Executive assured, the total capacity of the company’s cement plants in the state would be in the neighborhood of 18 million metric tons per annum, making it the highest cement-producing state or region in Africa.

“With the contributions of other cement producers in the state, Ogun remains far ahead of other countries across Africa in terms of cement production,” he said.

Dangote Cement, according to the Dangote Group President, is the leading cement producer in Africa with a capacity of 52.0 million metric tons per annum across the African continent.

He added that 70 percent of the production is carried out in Nigeria, with the Obajana plant in Kogi State accounting for 16.25 million metric tons per annum, the largest in Africa.

He said investment in the manufacturing of the product has made the nation self-sufficient in cement, just as the country is now self-sufficient in fertilizer, with the surplus going to the export market, thus earning the nation the needed foreign exchange.

While noting that the company’s target is to make Nigeria self-sufficient in whatever it consumes, Alhaji Dangote informed that the company is currently meeting domestic demand for Premium Motor Spirit (PMS) from its 650,000 barrels per day refinery at Ibeju-Lekki, as well as refined aviation fuel and Liquefied Petroleum Gas (LPG).

Nigeria, he said, is a growing economy; hence the need for private companies to complement government efforts, assuring that his company would continue to demonstrate its belief in the nation and its people by making investments targeted at transforming the nation’s economy.

He appreciated traditional rulers and the people of Itori for their support and partnership, which enabled the smooth and speedy take-off of the cement plant, adding that the encouragement from the people of Yewaland had fostered smooth operations, assuring continued adherence to its Corporate Social Responsibilities to the host communities.

Responding, Governor Abiodun described the day the Dangote Refinery groundbreaking was performed in Lagos as “the day of heartbreak for the sons and daughters of Ogun State as they watched helplessly on television,” saying it was an indication that the project had left Olokola.

He said: “I want to thank you for coming back to Ogun State and also for your belief and trust in your country, Nigeria. I want to thank you for all that you have done, the number of people you have employed, and the impact you continue to make not just in this state, but in Nigeria as a whole.

“The way you selflessly continue to promote this country all over the world, we can’t thank you enough. Your life and story continue to be an inspiring narrative for all young men. You have excelled in everywhere you touch; you have the Midas touch.

“These are indeed giant strides. For us in Ogun State, we welcome your return to the state. Today is a historic day, March 17, 2025, the same March when you did the groundbreaking in Lagos for the refinery, and you are now coming back in the month of March to Ogun State.

“Not only have you chosen to complete Itori, but you have also chosen to come back and develop the biggest port in Nigeria. For this, I thank you.”

Abiodun emphasized that with the establishment of the Itori cement plant, proposed to produce six million metric tons of cement per annum, and the existing Ibeshe plant, producing 12 million metric tons, cement production in the state would total 18 million metric tons per annum, making it the largest cement producer in Nigeria and sub-Saharan Africa.

The governor lauded the company for not shirking its Corporate Social Responsibilities to the host communities, just as it is currently constructing the Inter-change-Papalato-Ilaro road, assuring that his administration is ready to work with the company for the good of the state and the nation as a whole.